How convenience powers East Asia’s e-commerce growth

China, Japan, and South Korea accounted for 87% of Asia Pacific’s e-commerce sales in 2023.

The ability to “order at any time, from anywhere” is a key factor driving online shopping trends in East Asia, according to a new report from Euromonitor International.

“The demand for quick and efficient shopping solutions in the region is being driven by the tech-embracing, fast-paced nature of daily life in these three countries,” said Sachi Kimura, a consultant at Euromonitor International.

“E-commerce platforms are continuously evolving to meet the increasing need for convenience among consumers in East Asia,” she added.

The Unlocking E-Commerce in Asia and Beyond: Lessons from China, Japan, and South Korea report said East Asia remains a global leader in e-commerce, with China, Japan, and South Korea accounting for 87% of Asia Pacific’s e-commerce sales in 2023, and 40% of global sales. These markets are expected to continue their dominance, contributing 85% of the region’s retail e-commerce sales by 2028.

The health and beauty sectors are particularly strong online in East Asia, with the region’s established J-, K-, and C-Beauty markets leading the way. Four of the top ten beauty and personal care companies, and six of the top ten consumer health companies, are based in Asia Pacific.

Additionally, the food and drink sectors, though less penetrated online, are showing growth. South Korea experienced double-digit growth in online sales of traditional alcoholic beverages, whilst Japan saw a 14% increase in online soft drink sales, driven by a preference for bulk and sustainably packaged options. China, meanwhile, continues to lead in online FMCG spending.

“Low penetration can suggest the product nature and consumers’ preference is to shop in person,” Kimura noted. “However, convenience seeking is pushing these categories towards online channels, with many opportunities lying ahead.”

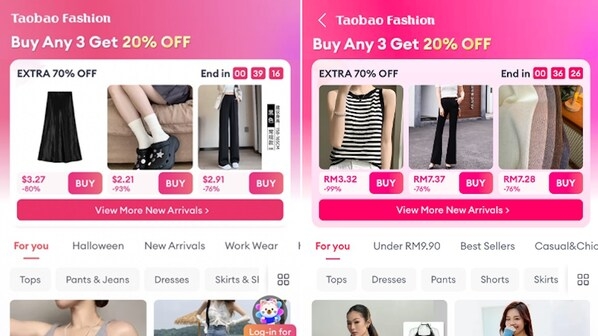

Unlike Western markets such as the US and UK, East Asia’s e-commerce is dominated by marketplace platforms. In China, Tmall and Douyin control over 70% of health and beauty online sales. Nearly half or 47% of Chinese consumers trust social media influencers for health information, and 27% consider social media influential in their dietary supplement decisions, both figures surpassing global averages, as per Euromonitor International’s Voice of the Consumer.

Moreover, Japan and South Korea also see dominance by marketplaces like Amazon and Rakuten in Japan, and Coupang and Naver in South Korea. Specialised online health and beauty shops such as South Korea’s Olive Young are growing by offering exclusive brands and competitive prices.

Yang Hu, insights manager for Health & Beauty Asia at Euromonitor International, said, “Digital marketplaces are constantly evolving. Through various channel sales, businesses can gain dynamic insights into market trends, consumer preferences, pricing strategies and promotional tactics.”

Source: Retail Asia