China’s Temu, Shein flood Vietnam with cheap goods

Chinese e-commerce platforms Temu and Shein, known for their steep discount strategies, are seeking to entice Vietnamese consumers by offering lavish promotions.

Le Hung of Hanoi recently got a dash camera three days after ordering on Temu, all for VND71,000 (US$2.8).

He had learned about Temu from a social media ad. After downloading the app he was told to create an account to get large discounts and shop immediately.

“Normally, dash cameras cost several times more, so I gave it a try,” he says.

If the total order is VND120,000 or more, shipping is free.

Bich Phuong in HCMC recently received a 94% discount voucher from Temu for her first order.

She bought two incense burner towers for VND50,000 each, half the price on Shopee.

Temu, owned by Chinese e-commerce giant PDD Holdings, launched in the U.S. in 2022 and has been expanding globally in recent years.

It now sells directly to consumers in 82 countries and territories, with the latest markets being Vietnam, Brunei, Malaysia, and the Philippines.

Chinse fashion brand Shein has also been active in Vietnam.

Nhu Mai of HCMC was introduced to the platform by a colleague who used it to buy phone cases and clothes.

“Purchases over VND200,000 qualify for free shipping,” she says.

Other Chinese platforms like Taobao, 1688, Pinduoduo, and JD are facilitating direct purchases by Vietnamese consumers.

Vietnam’s promising retail market and open policies are causing these large e-commerce players to flock to the country.

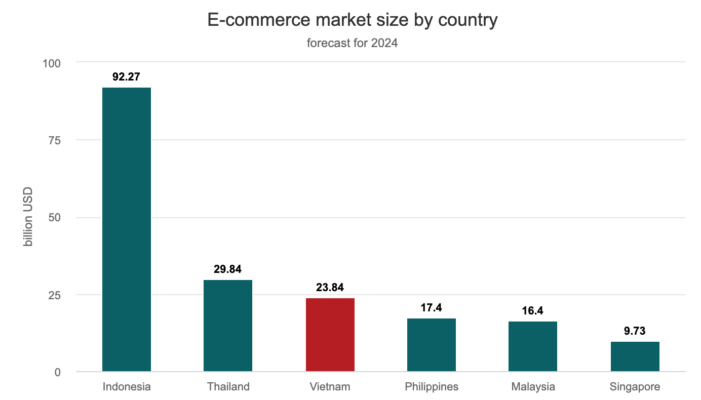

A report by Singapore research firm Momentum Works said Vietnam was the fastest growing market last year with gross merchandise volume rising by nearly 53% from 2022.

According to e-commerce data firm ECDB Vietnam ranks 21st globally and third in Southeast Asia after Indonesia and Thailand in terms of e-commerce market size with an estimated value of $23.8 billion this year.

Over the next four years it is projected to grow by 12.6% annually to top $38.2 billion by 2028, it added.

“Vietnam is becoming a lucrative market for investors, especially in cross-border e-commerce,” an official from department of e-commerce and digital economy, who asks not to be identified, tells VnExpress.

Vietnam’s e-commerce market has grown by 25% annually, with over 61 million people shopping online and spending $336 a year on average, according to the department.

Regulations require cross-border e-commerce platforms that use Vietnamese domains, display content in Vietnamese or process over 100,000 transactions annually from Vietnam must register with the Ministry of Industry and Trade.

But the ministry acknowledges that not all platforms are following the rule.

“The Ministry of Industry and Trade is increasing oversight and working with them to ensure platforms comply with the law and consumer rights are protected,” the official adds.

Pressure on local retailers

Platforms like Temu offer Vietnamese consumers direct access to cheap “made-in-China” goods, which is hurting domestic retailers, according to Tran Lam, an expert in online sales training.

Temu, along with Shopee, Lazada and TikTok, is flooding Vietnam with low-priced Chinese goods, and local sellers are suffering, unable to compete on price.

Some countries have are trying to prevent this influx of Chinese goods.

Temu was banned in Indonesia earlier this month, and is facing increasing scrutiny in the E.U. and the U.S.

The European Commission is considering imposing import duties on goods valued under EUR150 ($163).

Last month Washington announced measures to close a loophole that allowed tax-free import of items valued at under $800.

Frederic Neumann, co-head of Asia economics research at HSBC, says banning platforms like Temu and Shein in Vietnam might not be a good idea.

These platforms benefit consumers by offering low prices, the competition they bring causes domestic producers to improve product quality, and the entry of foreign giants encourages investment in logistics, benefiting consumers overall, he points out.

“Some countries take a hardline approach, but finding a way to integrate them into the ecosystem without causing too much disruption is the best outcome.”

He says authorities must introduce detailed regulations to allow Vietnamese producers to participate on platforms like Temu, and ensure there are no tax discrepancies between local and foreign goods.

For instance, Thailand previously did not impose import duties and VAT on goods costing under THB1,500, but since May this year all shipments are subject to a 7% VAT, thus protecting local production from cheap online imports, he says.

“The key is creating a level playing field.”

The Ministry of Industry and Trade official notes that managing cross-border e-commerce is a challenge for Vietnam and many other countries amid globalization.

Ministries have called for tweaking customs operations to separate ordinary goods flows from online purchases and increase control over foreign sellers.

They also want amendments to the VAT Law to ensure that products sold on digital platforms do not get any exemption.

Source: VnExpress